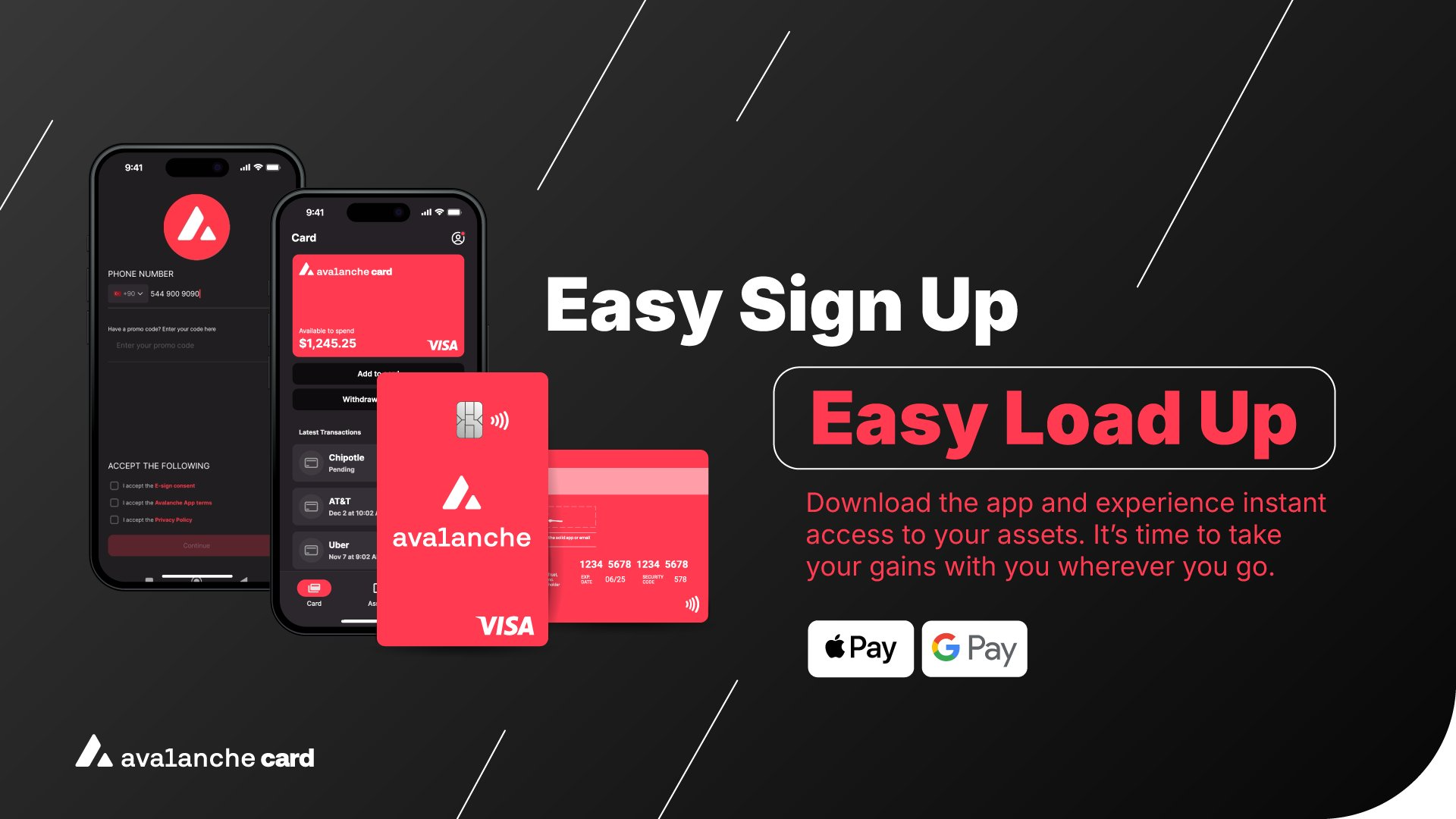

Avalanche Card App: The Easiest Way to Use Your Crypto with Visa

Behind the Avalanche Card—the card that allows users to spend cryptocurrencies anywhere Visa is accepted—there’s a key tool that enables the entire experience and real adoption: the Avalanche Card App.

Far from being a simple add-on, this app works as the main control hub where everything related to the card is managed: from identity verification to fund loading, spending control, and security measures.

Without it, the card would be little more than a decorative piece.

A Control Center in Your Pocket

The application, available on Android and iOS, brings together all essential functions.

From there, users can activate their card, top up in seconds, monitor transactions, and adjust security settings—all within a unified interface.

The startup process is quick: simply download the app, complete KYC verification, and activate the card—physical or virtual—in just minutes.

According to Avalanche Card, this process avoids lengthy forms or credit checks, prioritizing ease of access and global reach.

Once activated, the card can be directly integrated with Apple Pay or Google Pay, allowing users to spend cryptocurrencies in-store or online without manual conversions.

Seamless Top-Ups and Spending

One of the app’s strongest features is the ability to top up the card with crypto in real time.

Users can transfer assets like AVAX, USDC, USDT, or sAVAX, and instantly have funds available to spend anywhere Visa operates.

The platform charges no conversion fees: what you load is exactly what you can spend.

However, as with any blockchain transaction, small network fees (gas fees) may apply when moving funds within the Avalanche ecosystem.

Inside the app, balances are organized by asset, along with a detailed history of spending and top-ups.

It’s also possible to choose which currency to spend from—a useful feature for users managing mixed portfolios of stable and volatile tokens.

Security and Real-Time Control

The app offers a level of control comparable to leading financial platforms.

With just a few taps, users can lock or unlock the card, change the PIN, or receive instant notifications for every transaction, even abroad.

This constant monitoring minimizes the risk of unauthorized operations and gives users full autonomy over their money.

If any irregularity is detected, the app serves as a direct channel for support and dispute resolution.

In addition, the app operates through a self-custodial wallet, meaning users retain control over their private keys.

This feature reinforces decentralization, though it also means users bear full responsibility for the security of their funds.

What Users Are Saying

The app, which already surpasses 10,000 downloads on Android, has received positive feedback for its clean design and ease of use.

However, some users have reported a few technical issues.

Among them are unexpected logouts, SMS authentication code delays, and display errors when viewing the card after temporary blocking.

On iOS, the most recent version (1.5.2, September 2025) introduced performance improvements to reduce such issues.

Despite these remarks, most reviews highlight how quickly the main features can be activated and used.

Limits and Considerations

Although Avalanche Card aims for global usability, its application still has geographic restrictions.

The service is not available in countries such as Cuba, Venezuela, Russia, Iran, North Korea, or Syria, nor in regions under international sanctions like Crimea or Donetsk.

It’s also important to note the regulatory aspect.

In many jurisdictions, each crypto transaction may be considered a taxable event, requiring users to check local tax regulations before using the card as a regular payment method.

Lastly, while the system promises “no conversions or delays,” everything depends on the app’s proper functioning.

If the app experiences outages or maintenance, access to balances or payments may be temporarily limited.

A Step Toward Real Adoption

The official launch of the Avalanche Card and its companion app, announced on February 26, 2025, marked a major step forward in the practical adoption of cryptocurrencies.

In regions where traditional banking services are expensive or inaccessible, this tool seeks to provide a functional, fast, and intermediary-free alternative.

With its focus on simplicity and self-management, the Avalanche Card app turns crypto usage into an experience as direct as using a traditional card.

From topping up funds to tracking spending, every action happens within seconds—no technical processes visible to the user.

7

0

NEWSLETTER

Subscribe!

And find out the latest news

Other news you might be interested in

Etiquetas