Liquid Staking Explained: Multiply Your Capital with AVAX and LSTs

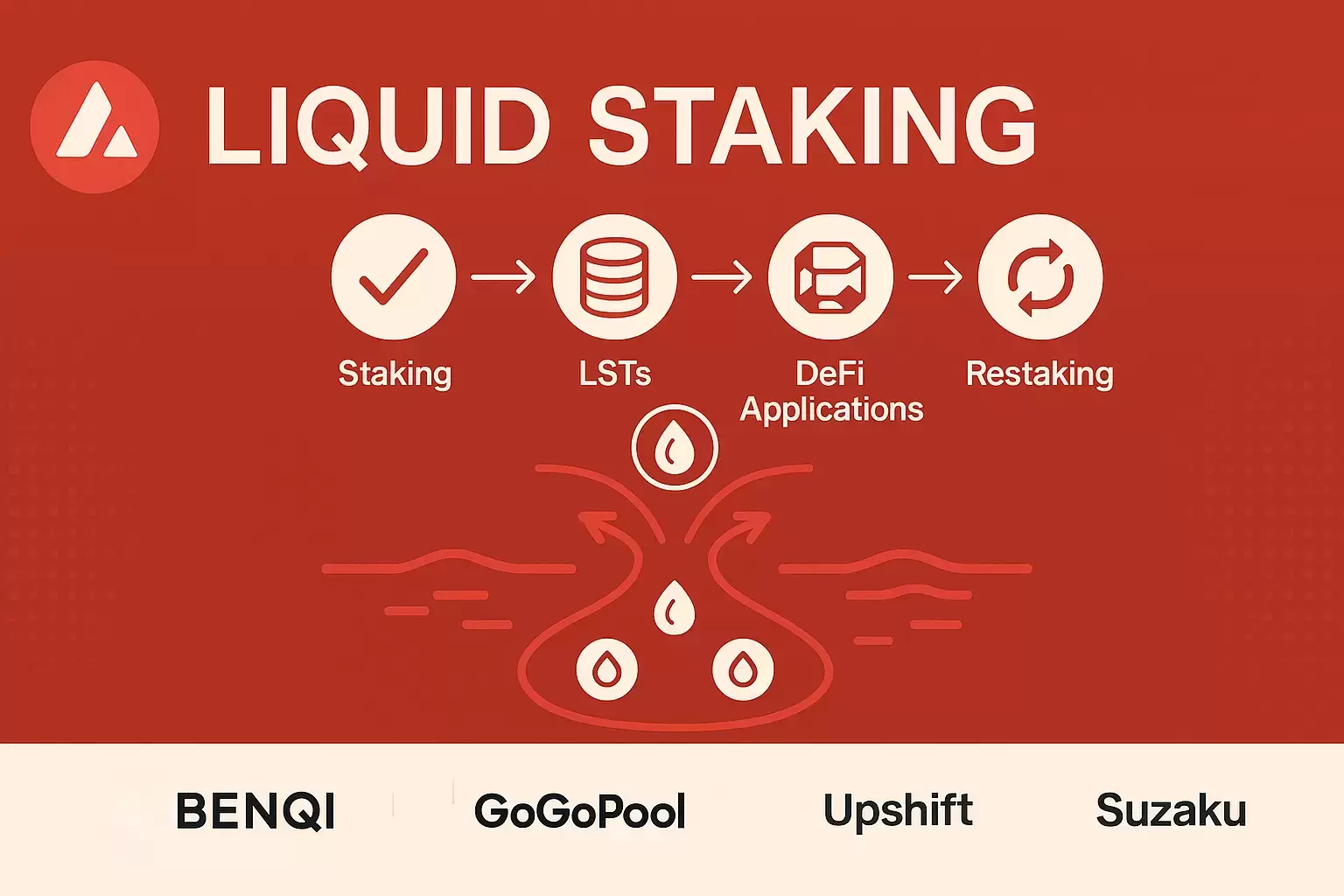

Liquid staking on Avalanche is becoming a core component within the DeFi ecosystem. Beyond enabling staking rewards, it unlocks new functionalities such as cross-chain capital efficiency, structured yield strategies, and lays the foundation for restaking and the use of real-world assets (RWA) as collateral.

Leading Projects in AVAX Liquid Staking

Platforms like Benqi Finance, GoGoPool, and Yield Yak are leading the development of native AVAX Liquid Staking Tokens (LSTs).

These projects have created tokens such as sAVAX, ggAVAX, and yyAVAX, which enable yield-bearing assets to move freely across various DeFi applications. Currently, LSTs account for over $245 million in staked AVAX.

New Use Cases Powered by LSTs

Avalanche’s DeFi ecosystem is leveraging LSTs to enable new capital-efficient applications, including:

- Vaults designed for stacked incentives.

- Collateralized lending using staked assets.

- Portfolio margining across multiple DeFi protocols.

- Structured products based on Avalanche-native assets.

Upshift: Simplifying DeFi Participation

Upshift is building solutions on top of this infrastructure through managed vaults that facilitate liquidity provision in Concentrated Liquidity AMMs. Users can make single-sided deposits and earn optimized returns using their LSTs, without the need to manage strategies manually.

Additionally, Upshift is developing a modular prime brokerage stack that allows users to:

- Borrow.

- Lend.

- Trade and settle across any EVM application, using liquid collateral powered by portfolio margin.

Progress Toward Restaking

With the support of Suzaku Network, LSTs such as sAVAX can also be restaked to help secure emerging layer 1 blockchains. This feature allows participants to earn additional rewards while keeping their assets liquid via Liquid Restaking Tokens (LRTs).

Restaking offers benefits such as:

- Generating additional yield on top of base staking rewards.

- Supporting decentralization of new networks.

- Maintaining liquidity of staked assets.

Liquid Staking: More Than Yield

Liquid staking on Avalanche is evolving into a comprehensive DeFi infrastructure. Its key contributions include:

- Creation of structured building blocks for investment strategies.

- Optimization of leverage across multiple protocols.

- Cross-chain composability.

- Integration of real-world assets as collateral.

- Expansion toward restaking.

Avalanche is positioning itself as an ecosystem that promotes capital efficiency in DeFi through the growth of LSTs and the new applications built around them.

12

0

NEWSLETTER

Subscribe!

And find out the latest news

Other news you might be interested in

Etiquetas