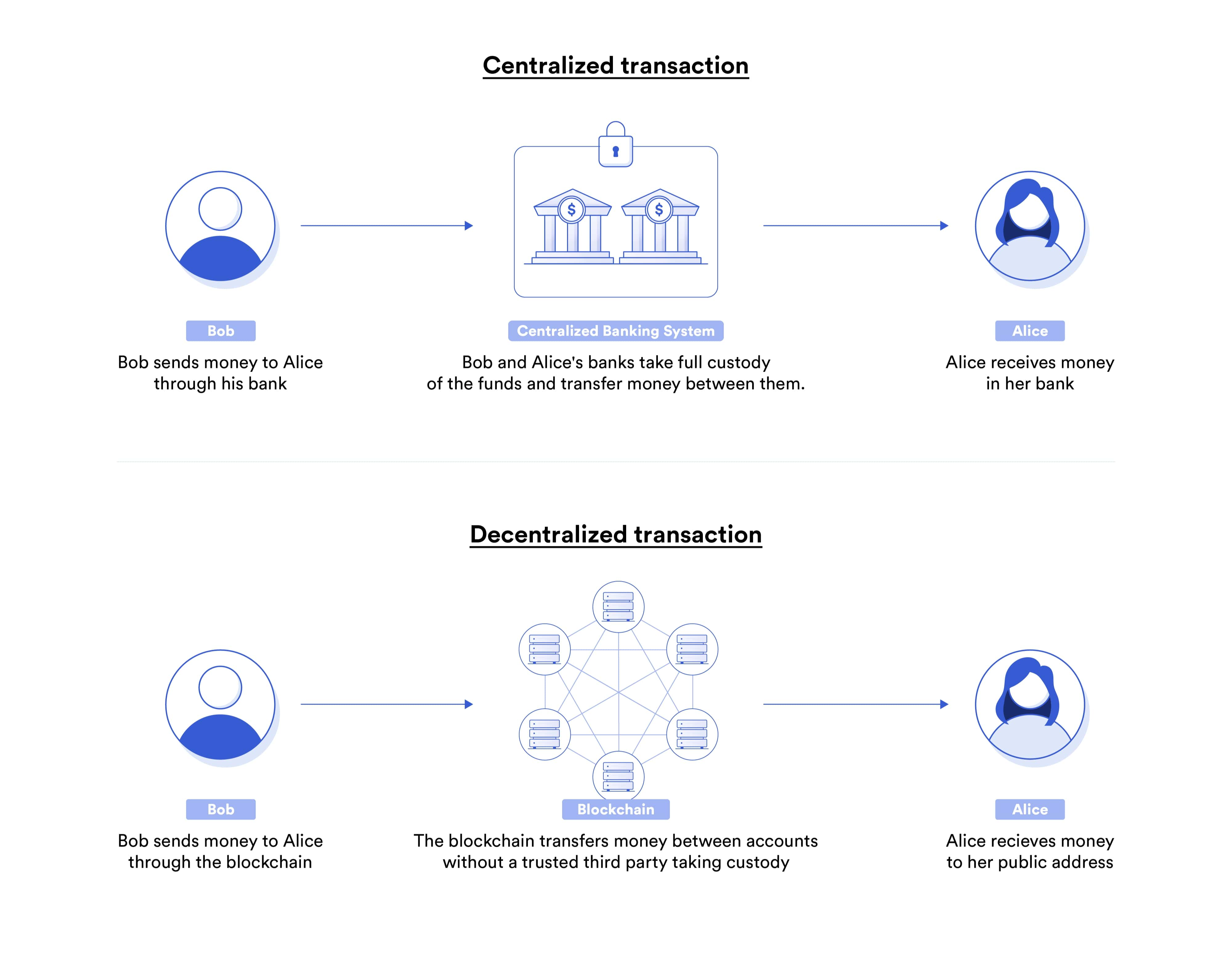

What if you could access financial services without relying on banks or intermediaries? Decentralized Finance, or DeFi, makes this possible.

DeFi represents one of the most significant advancements in the blockchain ecosystem. It refers to financial services built on decentralized networks that remove intermediaries like banks or brokers.

What is Decentralized Finance?

DeFi is a term that encompasses financial applications operating on public blockchains like Ethereum, allowing peer-to-peer transactions without a central authority.

Users can lend, borrow, exchange assets, earn yields, and even buy insurance — all in a secure, automated way through smart contracts.

How Does DeFi Work?

DeFi operations run on smart contracts: self-executing programs that define the terms of each transaction and execute automatically when conditions are met. This ensures transparency and removes human intervention.

Instead of banks, users interact with platforms called dApps (decentralized applications) using a digital wallet and just an internet connection.

Common Use Cases

- Lending and borrowing: crypto-backed loans between users.

- Staking: locking up crypto to support a network and earn rewards.

- DEXes: decentralized exchanges like Uniswap with no middlemen.

- Savings: earning interest with DeFi protocols.

- Trading and derivatives: trading futures, swaps, and more without brokers.

- Flash loans: no-collateral loans repaid in a single transaction.

Benefits of DeFi

- Accessibility: all you need is the Internet and a wallet.

- Autonomy: no third-party approvals needed.

- Transparency: everything is recorded on the blockchain.

- Low cost and speed: fewer fees and reduced waiting times.

- Interoperability: open-source, composable dApps.

Notable Examples

- AAVE: decentralized, automated, and secure lending platform.

- Uniswap: decentralized exchange for ERC-20 tokens with automated liquidity.

Requirements to Use DeFi

- Digital wallet: like MetaMask, to interact with dApps.

- Tokens: digital assets needed to operate.

- Internet connection: global access to services.

Risks and Considerations

⚠️ While DeFi offers financial freedom, it also requires responsibility.

- Volatility: highly variable crypto prices.

- Variable costs: high gas fees during network congestion.

- Self-management: users are responsible for keys, funds, and taxes.

- Lack of regulation: legal risks depending on the country.

DeFi is a new paradigm that puts control in the users' hands. While still evolving and not without risks, its potential to democratize finance and foster innovation is undeniable.

Want to Get Started with DeFi?

25

0

NEWSLETTER

Subscribe!

And find out the latest news

Other news you might be interested in

Etiquetas