From September 23 to 30, 2025, Nerite is hosting Arbitrum Week, an initiative designed to strengthen the protocol’s connection with the network’s ecosystem. The event combines boosted rewards, governance participation, and new liquidity options, aiming to position USND, Nerite’s stablecoin, as a core asset within Arbitrum.

Nerite: the largest CDP on Arbitrum

Nerite is currently the largest collateralized debt position (CDP) protocol by total value locked (TVL) on Arbitrum. Through it, users can mint the stablecoin USND by locking different assets as collateral.

The project’s mission is clear: for USND to become “the dollar of Arbitrum”, meaning the safest and most resilient stablecoin on the network. Arbitrum Week is a step in that direction, aligning Nerite with the key programs and incentives driving the ecosystem today.

5× ARB Rewards

One of the main highlights of the week is the boost in Shell Points, Nerite’s reward system. Between September 23 and September 30 at 5:00 PM EDT, all positions backed by ARB will receive a 5× multiplier: for every USND borrowed, users will earn five points instead of one.

With this incentive, the protocol aims to encourage the use of Arbitrum’s native token as collateral while rewarding those who use it to generate liquidity.

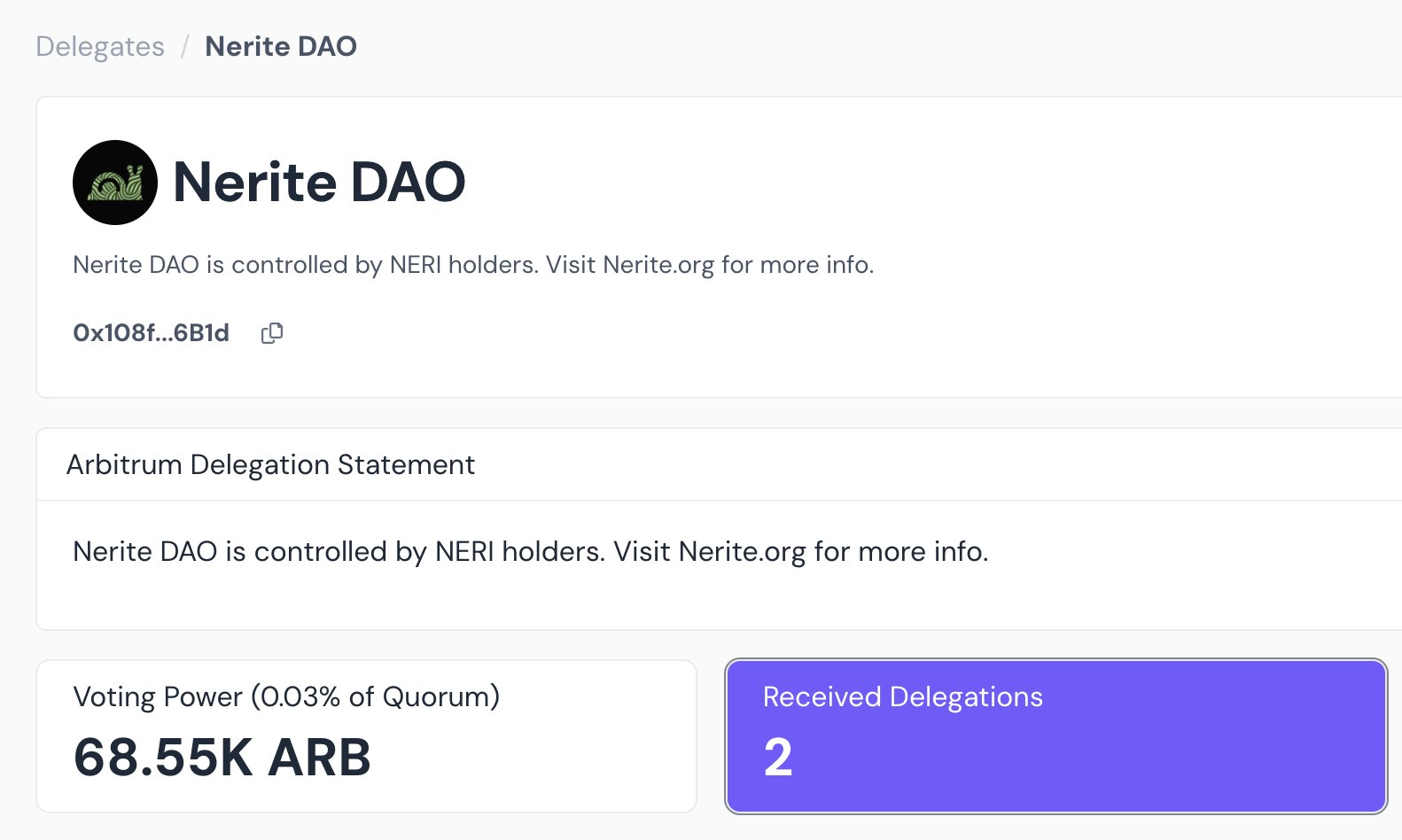

Over 65,000 ARB in Governance

Another key announcement is Nerite’s formal entry into Arbitrum DAO governance. The project has delegated more than 65,000 ARB through Nerite DAO, built on Aragon’s smart contract framework.

This allows the Nerite community to have a voice in strategic matters such as network upgrades and incentive allocation within Arbitrum.

It’s important to note that the governance token NERI is not yet active. For this reason, users cannot participate directly in voting, and the team warns of potential scams claiming otherwise.

New Liquidity Pools with Incentives

The initiative is also tied to the DRIP (DeFi Renaissance Incentive Program) launched by Arbitrum DAO to expand liquidity across the network. This program will distribute up to 24 million ARB in its first season, with a total budget of nearly $40 million in incentives.

In line with this, Nerite has created a Balancer pool pairing USND with USDC. The deposited USDC is rehypothecated in Euler’s eeUSDC vault, allowing liquidity providers to access DRIP incentives. Additionally, participants will earn double Shell Points for every dollar contributed.

Impact and Challenges of Arbitrum Week

With these measures, Nerite aims to:

- Strengthen the role of ARB, by incentivizing its use as collateral.

- Increase its influence in governance, through the delegation of over 65,000 ARB.

- Attract liquidity to USND, combining its own incentives with those from the DRIP program.

However, the campaign’s success will depend on user response. Incentives may attract short-term liquidity that migrates once rewards end, while future governance will require transparency to ensure community trust.

6

0

NEWSLETTER

Subscribe!

And find out the latest news

Other news you might be interested in

Etiquetas