How Arbitrum Powers the DeFi Yield Revolution with Pendle Finance

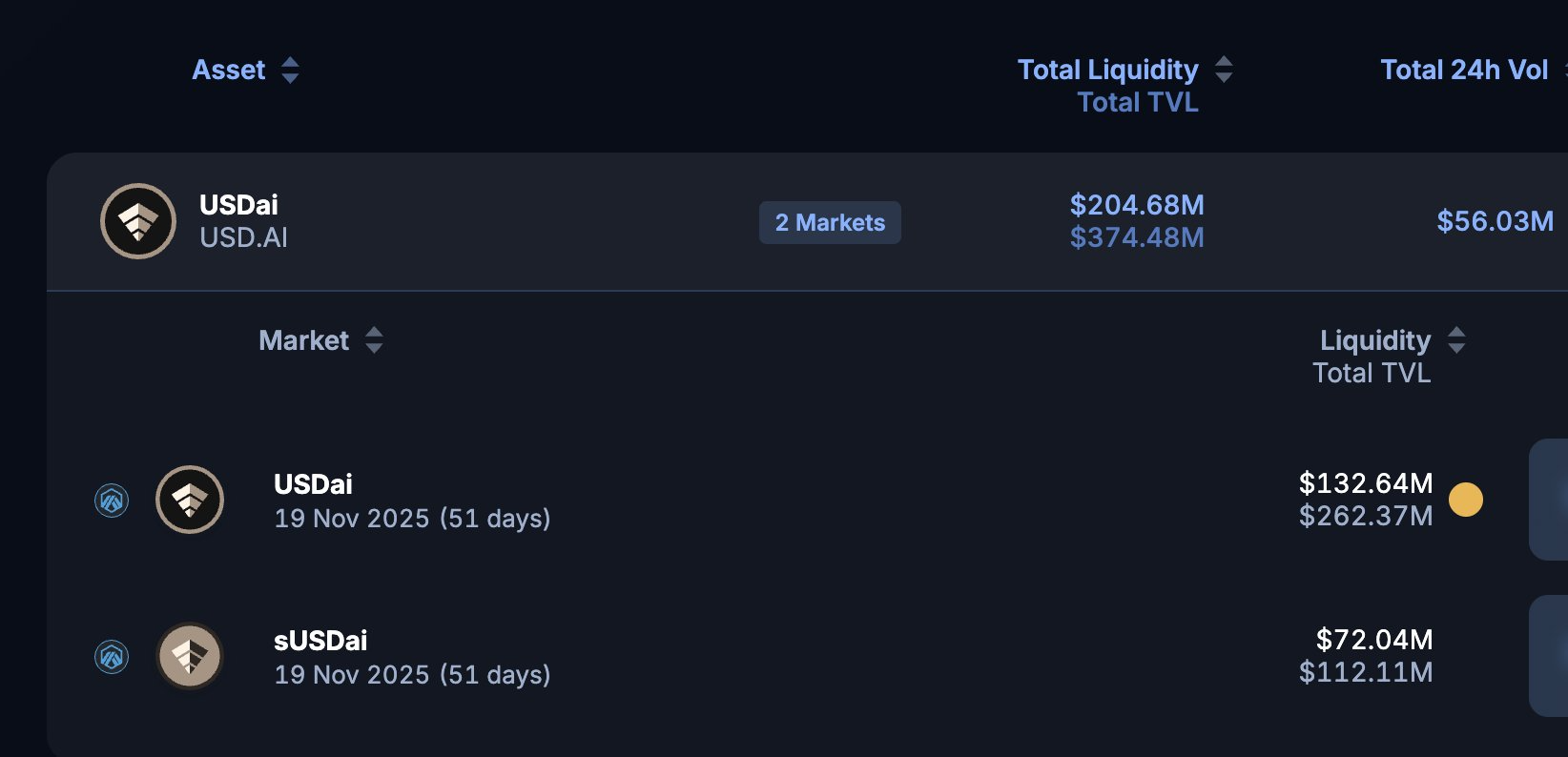

In the expanding landscape of decentralized finance, Pendle Finance stands out for its proposal to trade future yields on blockchain. Its alliance with Arbitrum and the integration of USDai and sUSDai have fueled its growth, reaching a TVL of $375 million.

This phenomenon highlights a clear point: the yield revolution in DeFi is happening now, and Arbitrum is at the center of it.

What Makes Pendle Different?

A New Way to Trade Yield

Unlike traditional protocols that simply generate interest, Pendle allows users to separate yield from the underlying asset. Each deposited token is split into two parts:

- PT (Principal Token): represents the base or principal value of the asset.

- YT (Yield Token): encapsulates the future interest that the asset will generate until maturity.

Thanks to this split, users can decide whether they want to secure a fixed yield by selling their YT or bet on higher future returns by buying them. The system works through a specialized AMM that automatically adjusts prices — even for time-expiring assets, which is rare in DeFi.

More Strategies, More Control

Pendle turns yield into a tradable market, opening up new management strategies: fixing income, speculating on rates, or providing liquidity to earn fees. This results in a more sophisticated ecosystem where users move beyond being simple depositors to becoming true yield traders.

Arbitrum and Pendle’s Expansion

Scalability and Efficiency

With its arrival on Arbitrum, Pendle benefits from a low-fee and high-speed network, ideal for frequent traders. This expansion, summarized in the slogan “Pendle Everywhere. Arbitrum Everywhere”, marks a key stage in the decentralization of the protocol.

As a layer-2 solution built on Ethereum, Arbitrum provides the infrastructure for Pendle to deploy yield markets more efficiently and at significantly lower costs. The protocol also participates in incentive programs within the network, boosting its adoption and liquidity.

The Launch of Boros: Beyond Traditional Yield

One of Pendle’s latest advancements is Boros, a platform built on Arbitrum that allows users to trade funding rates of assets like Bitcoin and Ether directly. With this tool, traders can open “long” or “short” positions on market yields without owning the underlying assets.

Each position is measured in Yield Units (YU), offering precise and limited exposure with moderate leverage. Following the launch of Boros, Pendle’s total TVL reached an all-time high of over $8 billion, solidifying its position within the DeFi ecosystem.

Stablecoins and the Rise of the USDai / sUSDai Pair

DeFi Seeks Stability

Interest in stablecoins has grown rapidly within Pendle. They now represent nearly 80% of the protocol’s TVL, showing users’ preference for earning yields without exposure to price volatility.

The recent mention of the USDai / sUSDai pair, with an estimated TVL of $375 million, suggests these stable assets are becoming the driving force behind Pendle’s growth. However, it’s worth noting that this figure has not yet appeared on public aggregators such as DefiLlama or in official reports, so it should be considered an unconfirmed estimate.

Even so, the dominance of stablecoin markets in Pendle indicates the platform is moving toward a more stable, efficient, and sustainable model in the long term.

5

0

NEWSLETTER

Subscribe!

And find out the latest news

Other news you might be interested in

Etiquetas