The decentralized finance (DeFi) ecosystem continues to evolve with the arrival of new instruments designed to expand investment opportunities and risk management. Two major projects —Ethena and Pendle— have joined forces on the Avalanche network to introduce fixed and variable yield markets based on sUSDe, a staked version of the synthetic stablecoin USDe.

This integration leverages Avalanche’s speed, scalability, and low fees to consolidate more sophisticated financial products.

Ethena and the Mechanics of USDe

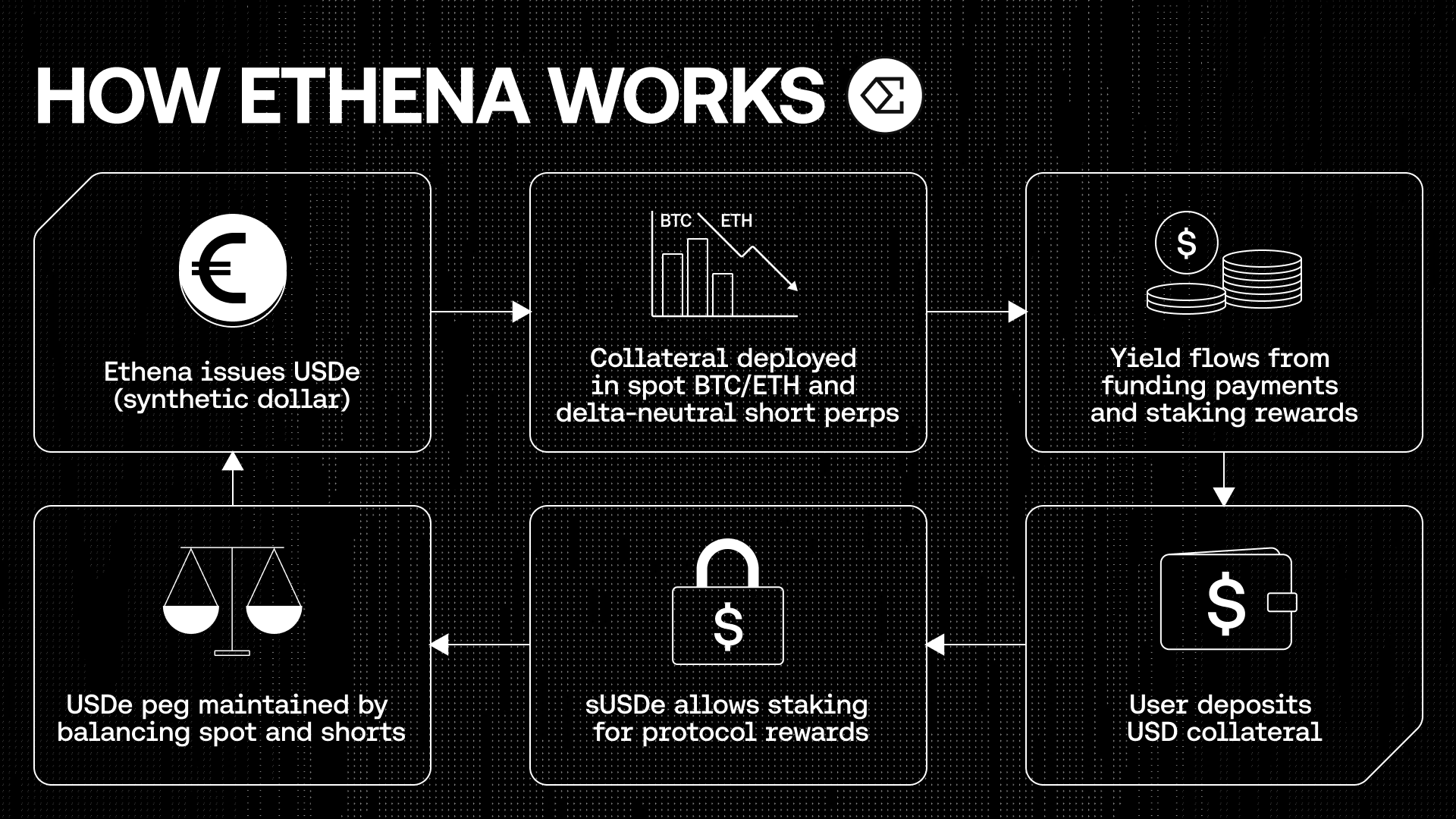

Ethena Labs created USDe as a synthetic stablecoin designed to maintain a peg close to one dollar. Unlike other stablecoins backed by fiat reserves, USDe uses a delta-neutral hedging strategy.

This consists of long positions in assets like bitcoin and ether, offset by short perpetual futures, so that price movements of the underlying assets tend to balance each other out. The staked version, known as sUSDe, allows users to lock their USDe in the protocol and receive a continuous stream of rewards.

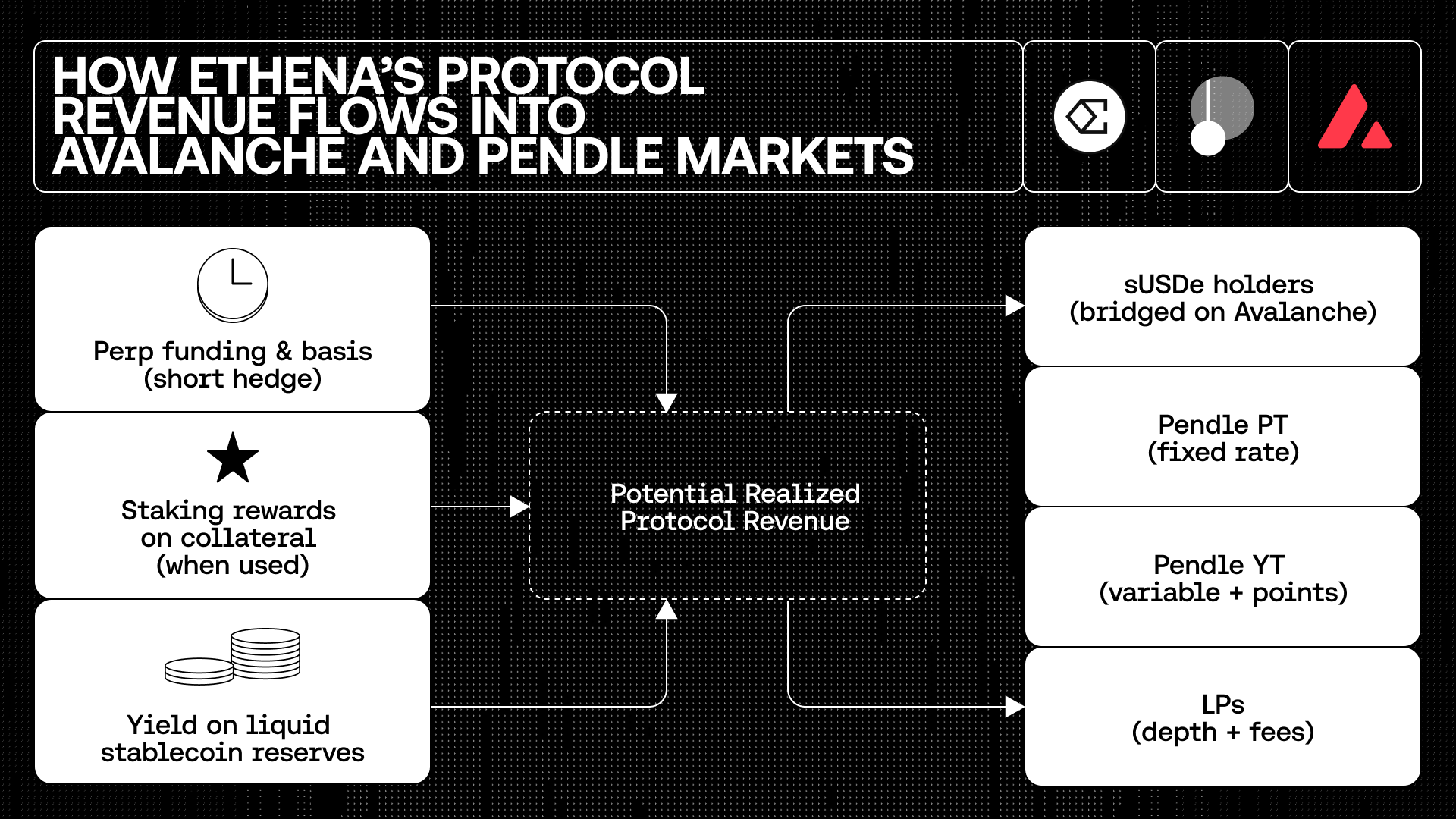

These yields are generated from several sources, including perpetual futures funding fees, profits from holding short positions, interest on stablecoin reserves, and staking rewards from collateral. When users exit their positions, they receive their original USDe plus the proportional share of accumulated revenue.

Pendle and Yield Tokenization

Pendle’s approach focuses on separating an asset’s yield into two components: the Principal Token (PT), representing the fixed or principal portion, and the Yield Token (YT), which offers exposure to variable returns.

In Ethena’s case, PT-USDe allows investors to secure stable returns through a discount on the asset, while YT carries higher risk as it depends directly on the performance of sUSDe-generated yield.

Liquidity providers in Pendle markets can also earn additional income through swap fees and incentives in the protocol’s native token. On Avalanche, this infrastructure is powered by LayerZero for cross-chain messaging, while assets and transparency remain local to the network, avoiding an omnichain model.

Expansion on Avalanche

Avalanche contributes key technical features to this integration: fast transaction confirmation, low costs, and a growing ecosystem that supports the adoption of innovative financial instruments.

With the addition of sUSDe and Pendle markets, users can now leverage this asset not only as a stability tool but also as collateral for loans or as a foundation for diversified yield strategies.

In this model, investors may choose the relative safety of fixed returns via PT, or the potential volatility of YT, which fluctuates with market cycles. When demand for perpetual futures increases, funding rates rise and sUSDe yields may expand. Conversely, during periods of reduced activity, yields decline along with supply.

Current Ecosystem Data

The relevance of this integration becomes clearer when reviewing the latest figures. As of September 2025, USDe holds a market capitalization of approximately $13 billion, with steady supply growth. Pendle, meanwhile, has surpassed $5 billion in total value locked (TVL), nearly half of which comes from the use of Principal Tokens as collateral.

Ethena’s governance reports note that around 46% of USDe’s backing comes from delta-neutral strategies, with an allocation of roughly 31% in bitcoin, 10% in ether, 4% in liquid staking derivatives of ether, and less than 1% in solana.

Some Pendle pools associated with USDe on Avalanche have already reached their authorized collateral limits. These figures highlight both adoption levels and current restrictions in certain markets.

Adoption Status and Next Steps

Currently, sUSDe already has liquidity on decentralized exchanges such as Uniswap, LFJ, Pharaoh Exchange, and BlackholeDex. In the coming weeks, integrations are expected with platforms like Euler, Silo, Folks Finance, and Term Labs, where it can be used as collateral.

Discussions are also underway regarding the addition of sUSDe to larger-scale protocols like Benqi and Aave, though these depend on governance decisions and prior technical testing. Timelines may vary, as implementation relies on each partner’s deployment schedule and adjustments to their risk parameters.

56

0

NEWSLETTER

Subscribe!

And find out the latest news

Other news you might be interested in

Etiquetas